CALL US TODAY (901)683-5955

About Us

At WABTS, we pride ourselves on providing exceptional accounting, bookkeeping, payroll, tax consulting, and tax preparation services tailored to meet the needs of our individual and business clients.

Our services are strategically designed to allow individuals and business owners to focus on their vision, mission, and goals. As they pursue their passions, we ensure that the overall health of their business affairs is in order regarding the accuracy of financials, consistency with projected budgets for desired growth, and compliance with tax laws on all levels.

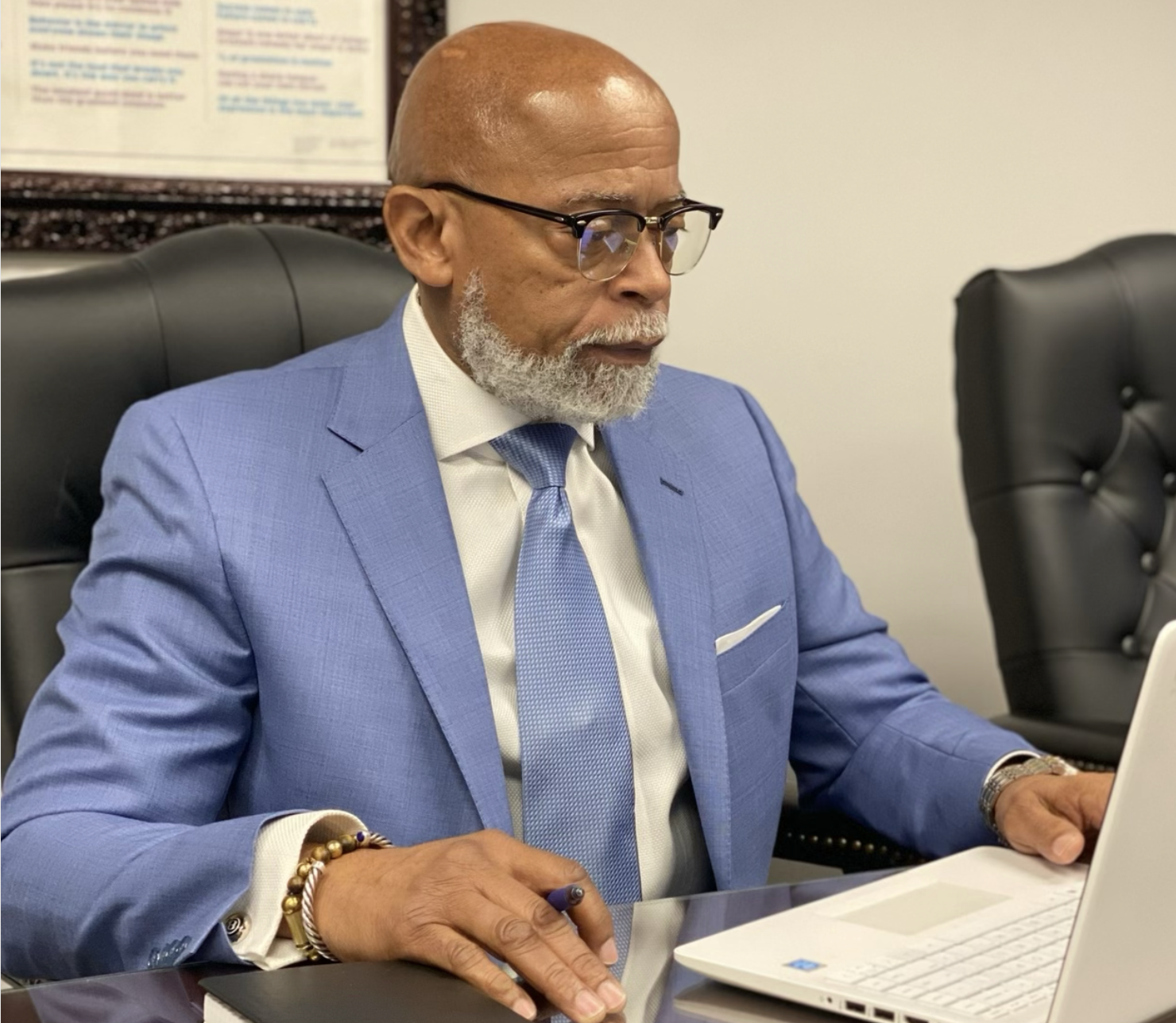

Herb D. Wilkins

Founder & CEO

Our CEO, Herb D. Wilkins, has dedicated over 40 years to our community and region with his accounting and tax expertise. Delivering honest and trustworthy service to each client has been and continues to be his core value and foundation of WABTS.

Headquarters located in Memphis, TN

Since its birth, WABTS has specialized in individual and small business taxes. Over the last four decades, we have evolved into a now one-stop shop offering additional financial services including business set up, accounting and bookkeeping, budgeting, payroll, and much more.

This one stop shop operation has grown over time due to our clients putting their trust in our Founder and staff’s professionalism and abilities to successfully manage and advise them on their financial concerns.

Our Vision

Our vision at WABTS is to be the trusted partner and unwavering support system for individuals and businesses in their financial endeavors. We aim to set the standard in the industry by delivering consistently superior accounting and financial services, fostering long-term success, and enabling our clients to thrive, secure in the knowledge that their financial matters are expertly managed.

Our Mission

At WABTS, our mission is to serve as a reliable financial partner for individuals and businesses. We offer customized accounting, bookkeeping, payroll, tax consulting, and tax preparation services. Our objective is to empower our clients to chase their dreams and goals, and assured that their financial stability, growth, and adherence to tax laws are managed competently.

Our Value

At WABTS, our values encompass integrity, professionalism, and client-centricity. We are steadfast in our commitment to ethical conduct, strive for excellence in all that we do, and place our client’s best interests above all. Our relationships are built on trust, accountability, and a relentless pursuit of our clients' financial well-being.

Our Services

As a team player to our clients, we have effectively cultivated strong internal/external relationships, linking finance and operations to improve productivity and efficiency with positive bottom-line results.

Accounting & Bookkeeping

We assist clients with their in-house accounting and bookkeeping needs. Outsourcing these services allows our clients more time to focus on growing their business while simultaneously reducing operating cost.

Preparing Financial Statements

Balance SheetIncome Statement (Profit & Loss)

Forensic Accounting

Budget and Budget Variance Report (Business and Personal)

Accounts Receivable/ Payable Reports

Bank Statements and Credit Cards

Statement Reconciliation

Business/Consulting Services

QuickBooks TrainingStrategic Planning

Employee Motivation

Internal Controls Evaluation

Cash Flow Analysis

Management Consulting

Incorporate (Converting existing business and new business)

Business Plans, Loan Packaging & Proposals

Assist with the preparation of the Annual Audit (if required)

Business Setup

We complete and submit all federal, state, and local registrations as it relates to new businesses, their entity types, and respective industries. This eliminates any hassle for new business owners and ensures the accuracy of all filings.

Launch Your Business

Establish a Business NameDetermine Entity Type

Register with Secretary of State

Determine Effective Start Date

Legal Compliance

Apply for EIN

Identify NAICS Code

Determine Fiscal Tax Year

Identify Directors, Officers, and Shareholders

Payroll Services

Since 2014, WABTS has expanded its abilities to service clients payroll needs by partnering with ADP (Automatic Data Processing) to provide payroll services not only to clients with 1 to 25 employees, but now the number of employees are unlimited.

Simplify Your Payroll

Lower risk of compliance-related issues and penalties are payroll tax and payroll processingVast reductions in time, effort, and money spent on managing and running payroll

Mobile tools that put payroll information into the hands of HR managers and workers, wherever they are

Simpler, more efficient processes across every area of your business that intersect with small business payroll services, like retirement plans and workers' compensation insurance

Tax Consulting & Preparation

We specialize in small business and individual taxes. To ensure our clients are given proper tax advice, we stay abreast of tax law changes throughout the year. In addition, we have used a state of the art tax software for over 20 years to prepare individual and business tax returns.

Tax Preparation & Planning

Business & Corporate TaxesIndividual Taxes

Estimated Taxes

Tax Analysis & Planning

IRS Negotiations & Plans (Offer in Compromise)

Business License

Sales & Local Tax

Payroll TaxesBusiness License Tax

Business Property Tax

Sales & Use Tax

Personal Property Tax

We understand how valuable your time is, and that's why we've made it even easier for you to track the status of your refund. Simply click the button below, and you'll be one step closer to the financial clarity you deserve.

Meet The Team

Ke'Unnia Itson

Sr. Tax Accountant

Deaunte Houston

Chief Accountant

Kourtney Moore

Sr. Accountant

Ramesha James

Accountant

Marc Wilkins

Chief Marketing Officer

Frequently Asked Questions

What services does your accounting and tax firm offer?

At WABTS, we provide a comprehensive range of services, including tax planning and preparation (Individuals and Businesses), bookkeeping, budgeting, payroll services, audit services, forensic accounting, and more. We tailor our services to meet your unique financial needs..Do you only serve clients in a specific city or state?

No, we serve clients across America. Whether you're in a major city or a rural area, our team is ready to assist you with your accounting and tax needs.How can I get started with your services?

Getting started is easy. Simply contact us via the form below. We'll schedule an initial consultation to discuss your needs and how we can assist you.What documents and information must I provide for tax preparation?

The specific documents you'll need depend on your individual or business situation. Generally, you should gather W-2s, 1099s, income and expense records, and any other relevant financial documents. Our team will provide you with a personalized checklist.How do your fees work?

Our fees vary based on the services you require. We offer transparent pricing and will provide a quote after discussing your needs during the initial consultation. We aim to provide cost-effective solutions. Also, a retainer fee is required before service beginIs my information secure with your firm?

Absolutely. We take data security and client confidentiality seriously. Your information is treated with the utmost care and protected according to industry standards and regulations.Can you help with tax planning and saving strategies

Yes, tax planning is a key component of our services. We work with clients to identify opportunities to reduce tax liability and implement strategies for long-term financial success.What sets your firm apart from other accounting and tax services?

We are a one-stop organization (Accounting, Bookkeeping, Payroll, Tax Planning and Preparation). Our firm prides itself on our expertise, personalized approach, and commitment to client satisfaction. We go the extra mile to understand your unique financial situation and provide tailored solutions.Do you work with individuals, small businesses, and corporations?

Yes, we have experience serving a wide range of clients, including individuals, small businesses, and corporations. Our team has the expertise to meet your specific needsHow do I schedule a consultation?

Scheduling a consultation is simple. You can call us at 901-683-5955, email us at herbwilkins@wabts.us, or fill out the contact form below. We'll get back to you promptly to schedule an appointment.Contact Us

herbwilkins@wabts.us

(901) 683-5955

"Two years with WABTS for bookkeeping has been exceptional. Their knowledgeable and communicative team ensures seamless financial management. Highly recommend for their expertise and dedication to client success!"

Sheronda SmithCEO & Founder

Sheronda SmithCEO & Founder